What is a fixed indexed annuity?

A fixed indexed annuity is a contract between you and the insurance company that is designed to help you reach your long-term financial goals. Your account has the built-in benefit of downturn protection, meaning your account value remains stable even if the market experiences lows.

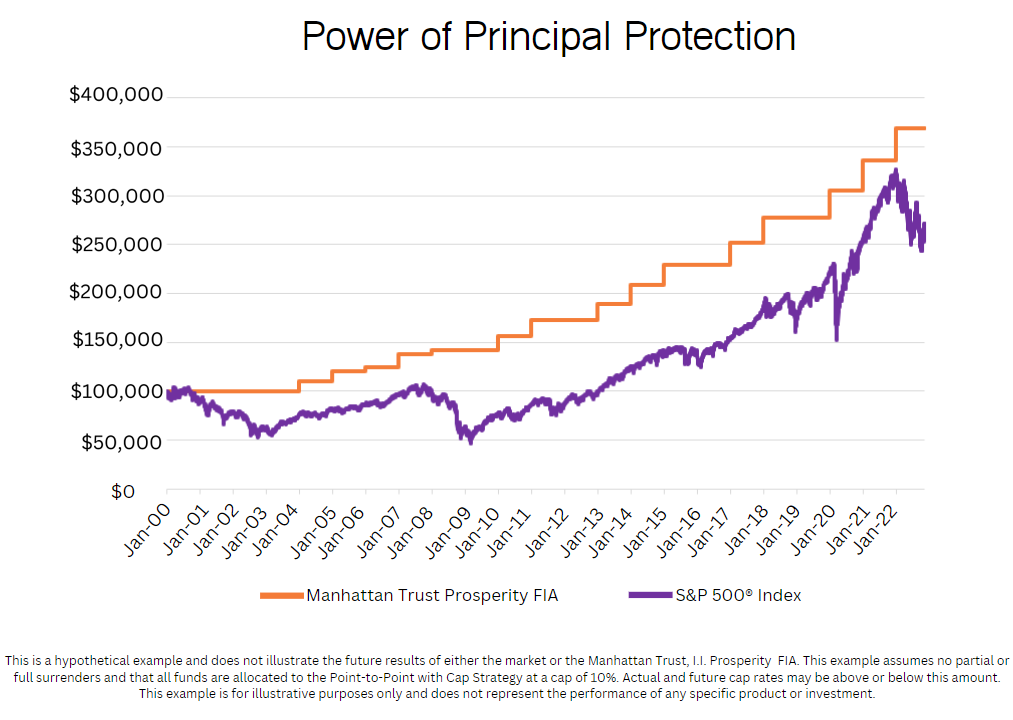

What can downturn protection look like?

Hypothetical Account Value Growth

The following examples display different market scenarios and how they would impact a portfolio of equity investments (such as stocks), versus how they would impact a Fixed Indexed Annuity.