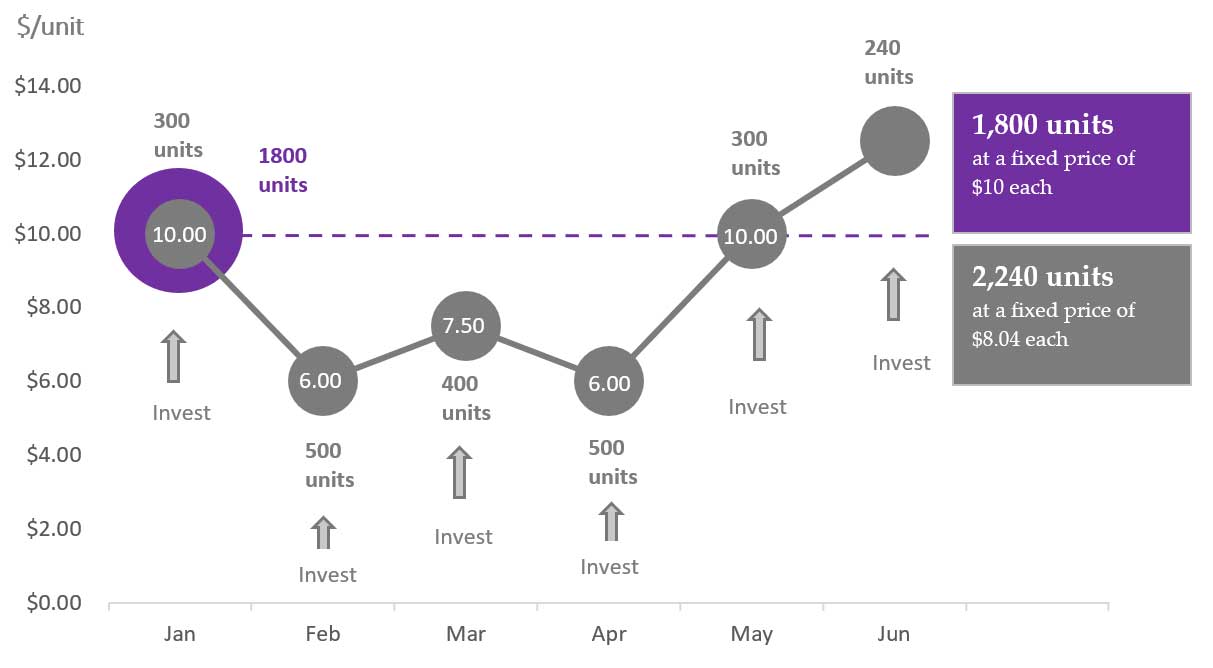

How does Dollar Cost Averaging work?

Not only are your payments more affordable if you contribute payments to your savings over time, but you also enjoy the benefits of dollar-cost averaging. This strategy allows you to buy more shares when the price is lower and fewer shares when the price is high, potentially lowering your average price over time and decreasing your sensitivity to market declines.